An Overview of GST: In the earlier Indirect Tax Law (Excise Duty, Service Tax, VAT etc.), the Central Government levies tax on, manufacture of certain goods in the form of Central Excise duty, provision of certain services in the form of service tax, inter-State sale of goods in the form of Central Sales tax. Similarly, the State Governments levy tax on and on retail sales in the form of value added tax, entry of goods in the State in the form of entry tax, luxury tax and purchase tax, etc. Accordingly, the earlier indirect tax system is plagued with multiplicity of taxes – at different rates – at multiple points. Further, absence of any setting off mechanism results in cascading effect of these taxes. This is accentuated by a huge compliance cost that is incurred in respect of each of the taxes.

DIFFICULTIES/PROBLEM IN THE PRESENT INDIRECT TAX SYSTEM:

- There is cascading of taxes as taxes levied by the Central Government are not available as set off against the taxes being levied by the State Governments;

- Certain taxes levied by State Governments are not allowed as set off for payment of other taxes being levied by them;

- The variety of Value Added Tax Laws in the country with disparate tax rates and dissimilar tax practices divides the country into separate economic spheres; and

- The creation of tariff and non-tariff barriers such as octroi, entry tax, check posts, etc., hinder the free flow of trade throughout the country. Besides that, the large number of taxes create high compliance cost for the taxpayers in the form of number of returns, payments, etc.

In view of the aforesaid difficulties, all the above mentioned taxes are proposed to be subsumed in a single tax called the Goods and Services Tax which will be levied on supply of goods or services or both at each stage of supply chain starting from manufacture or import and till the last retail level.

So, any tax that was being levied by the Central Government or the State Governments on the supply of goods or services is now converged in Goods and Services Tax which is proposed to be a dual levy where the Central Government will levy and collect tax in the form of central goods and services tax and the State Government will levy and collect tax in the form of state goods and services tax on intra-State supply of goods or services or both.

EXPECTATION FROM GST LAW:

The new Indirect Tax law (i.e. GST) is confer power upon the Central Government for levying Goods and Services Tax on the supply of goods or services or both which takes place within a State. Following are the main expectation from GST:

- GST legislation will simplify and harmonise the indirect tax regime in India;

- Reduce cost of production and inflation in the economy, thereby making the Indian trade and industry more competitive, domestically as well as internationally.

- Due to the seamless transfer of input tax credit from one stage to another in the chain of value addition, there is an in-built mechanism in the design of goods and services tax that would incentivise tax compliance by taxpayers.

- The New Indirect Tax Law will broaden the tax base, and result in better tax compliance due to a robust information technology infrastructure.

GST STRUCTURE IN INDIA

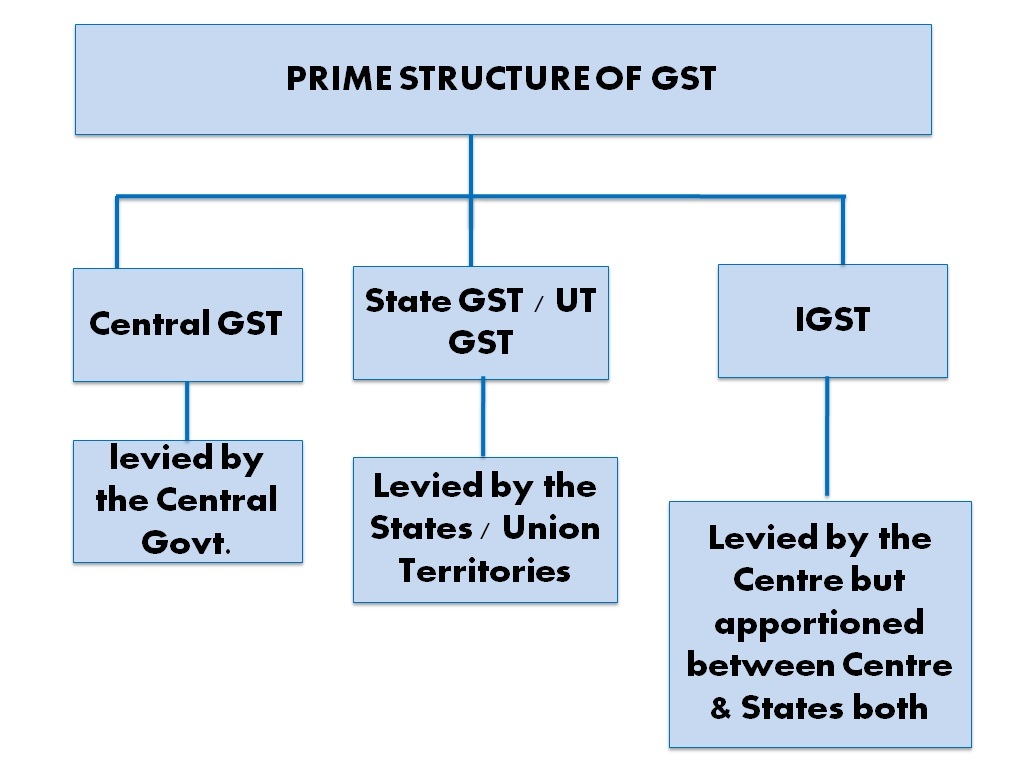

Centre will levy and administer CGST & IGST while respective States/Union Territories will levy and administer SGST/ UTGST.

It would be a dual GST with the Centre and States simultaneously levying it on a common tax base. The GST to be levied by the Centre on intra-State supply of goods and / or services would be called the Central GST (CGST) and that to be levied by the States/ Union territory would be called the State GST (SGST)/ UTGST. Similarly, Integrated GST (IGST) will be levied and administered by Centre on every inter-state supply of goods and services.

India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes through appropriate legislation. Both the levels of Government have distinct responsibilities to perform according to the division of powers prescribed in the Constitution for which they need to raise resources. A dual GST will, therefore, be in keeping with the Constitutional requirement of fiscal federalism.

EXISTING TAXES SUBSUMED IN GST LAW

(i) Taxes currently levied and collected by the Centre:

- Central Excise duty

- Duties of Excise (Medicinal and Toilet Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

- Central Surcharges and Cesses so far as they relate to supply of goods and services

(ii) State taxes that would be subsumed under the GST are:

- State VAT

- Central Sales Tax

- Luxury Tax

- Entry Tax (all forms)

- Entertainment and Amusement Tax (except when levied by the local bodies)

- Taxes on advertisements

- Purchase Tax

- Taxes on lotteries, betting and gambling

- State Surcharges and Cesses so far as they relate to supply of goods and services

The GST Council shall make recommendations to the Union and States on the taxes, cesses and surcharges levied by the Centre, the States and the local bodies which may be subsumed in the GST.

EXISTING TAXES NOT SUBSUMED IN GST LAW

Taxes currently levied and collected by the Central Government:

- Basic Customs Duty (never included in GST, being tariff barrier)

- Duty of Excise on tobacco and tobacco products (will be levied over and above GST)

- Terminal taxes on goods or passengers, carried by railway, sea or air; taxes on railway fares and freights

- Central Stamp Duties

- Existing Cess like Oil Industries Development Act Cess, Clean Environment Cess etc.

Taxes currently levied and collected by the State Government:

- Fees in respect of markets and fairs (Mandi fees)

- Taxes on lands and buildings (property tax)

- State Stamp Duties

- Taxes on mineral rights (Royalties)

- Electricity Duty

- Taxes on goods and passengers carried by road or on inland waterways

- Taxes on vehicles (Road Transport Authority)

- Tolls tax.

- Taxes on professions, trades, callings and employments.

- Entertainment Tax by local bodies.

GOODS KEPT OUTSIDE GST

- Alcoholic liquor for human consumption;

- Petroleum crude

- High speed diesel

- Motor spirit (commonly known as petrol)

- Natural gas

- Aviation turbine fuel

- Actionable claims except lotteries, betting and gambling o Specified Real Estate

- Money

GOODS AND SERVICES TAX COUNCIL (GSTC)

The GSTC is a Constitutional Body created for taking policy decisions about introduction and implementation of GST, including about exemptions, tax rates and tax credits. The GST Council is structured as follow:

| (a) the Union Finance Minister | Chairperson |

| (b) the Union Minister of State in charge of Revenue or Finance | Member |

| (c) the Minister in charge of Finance or Taxation or any other Minister nominated by each State Government | Members. |

ANTI-PROFITEERING MEASURE

As per section 171 of the CGST Act, 2017 any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices. An authority may be constituted by the government to examine whether input tax credits availed by any registered person or the reduction in the tax rate have actually resulted in a commensurate reduction in the price of the goods or services or both supplied by him.

COMPLIANCE RATING MECHANISM

As per Section 149 of the CGST Act, 2017 every registered person shall be assigned a compliance rating based on the record of compliance in respect of specified parameters. Such ratings shall also be placed in the public domain. A prospective client will be able to see the compliance ratings of suppliers and take a decision as to whether to deal with a particular supplier or not. This will create healthy competition amongst taxable persons.

Benefits of Goods and Services Tax (GST)

GST stands for Goods and Services Tax which is levied on the supply of goods or services or both in India. GST subsumes a number of existing indirect taxes which were earlier levied by the Centre and State Governments including Central Excise duty, Service Tax, VAT, Purchase Tax, Central Sales Tax, Entry Tax, Local Body Taxes, Octroi, Luxury Tax, etc.

It brings benefits to all the stakeholders’ viz. industry, government and the citizens. It is expected to lower the cost of goods and services, boost the economy and make our products and services globally competitive. GST will make India a common national market with uniform tax rates and procedures and removes the economic barriers, thereby paving the way for an integrated economy at the national level. By subsuming most of the Central and State indirect taxes into a single tax and by allowing a set-off of prior-stage taxes for the transactions across the entire value chain, GST would mitigate the ill effects of cascading and thereby improve competitiveness of Indian Industry.

GST is a destination based consumption tax. It has been designed in a manner so that tax is collected at every stage and the credit of tax paid at the previous stage is available to set off the tax to be paid at the next stage of transaction thereby eliminating cascading of taxes. This eradicates “tax on tax” and allows cross utilization of input tax credits which benefit the industry by making the entire supply chain tax neutral.

GST will give a major boost to the ‘Make in India’ initiative of the Government by making goods or services produced or provided in India competitive in the national and international markets. Further, all imported goods will be charged with integrated tax (IGST) which will be more or less equivalent to Central GST + State GST. This brings parity in taxation on local and imported products.

Under the GST regime, exports are zero rated in entirety unlike the earlier system where refund of some taxes was not allowed due to fragmented nature of indirect taxes between the Centre and the States. All taxes paid on the goods or services exported or on the inputs or input services used in the supply of such export goods or services shall be refunded. The principle of exporting only the cost of goods or services and not taxes would be followed. This will boost Indian exports thereby improving the balance of payments position. Exporters are being facilitated by grant of provisional refund of 90% of their claims within seven days of issue of acknowledgement of their application, thereby resulting in the easing of position with respect to cash flows.

GST is expected to bring buoyancy to the Government Revenue by widening the tax base and improving the taxpayer compliance. GST is likely to improve India’s ranking in the Ease of Doing Business Index and is estimated to increase the GDP by 1.5% to 2%.

GST prevents cascading of taxes by providing a comprehensive input tax credit mechanism across the entire supply chain. Such a seamless availability of Input Tax Credit across goods or services at every stage of supply will enable streamlining of business operations.

Uniform GST rates will reduce the incentive for evasion by eliminating rate arbitrage between neighboring States and that between intra and inter-State sales.

Harmonization of laws, procedures and rates of tax makes compliance easier and simple. There are common definitions, common forms/ formats, common interface through GST portal resulting in efficiencies and synergies across the board. This will also remove multiple taxation of same transactions and inter-State disputes like the ones on entry tax and e-commerce taxation existing today. All this will also help in reduction in compliance costs, alleviate the need for multiple record keeping for a variety of taxes leading to lesser investment of resources and manpower in maintaining records.

Common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, common system of classification of goods or services along with timelines for every activity will lend greater certainty to taxation system.

GST is largely technology driven. The interface of the taxpayer with the tax authorities is through the common portal (GSTN). There are simplified and automated procedures for various processes such as registration, returns, refunds, tax payments, etc. All processes, be it of applying for registration, filing of returns, payment of taxes, filing of refund claims etc. , is done online through GSTN. The input tax credit will be verified online. Electronic matching of input tax credit all – across India will make the process more transparent and accountable. This will encourage a culture of compliance. This will greatly reduce the human interface between the taxpayer and the tax administration leading to speedy decisions.

Average tax burden on trade and industry is likely to come down, which is expected to reduce prices resulting in more consumption, which in turn means more production and thereby boosting the growth of the industries. The removal of cascading of taxes and increased transparency will make the citizens more informed about the taxes they pay while purchasing goods or services. GST will boost domestic demand, create more opportunities for domestic business and drive job creation. GST might not be the panacea for all the ills of indirect tax system but is also not far from that.