February 18, 2016

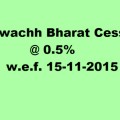

CBEC Notification 06/2016-ST dated 18-02-2016 : W.e.f. 01-04-2016 Reverse Charge Applicable on Services provided by Government or Local Authority to business entity (having turnover of more than 10 lacs in preceding F.Y.)

Also read : No Service Tax on Services by Government or local authority to a small business entity

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

New Delhi, the 18th February, 2016

Notification No. 06/2016-Service Tax

G.S.R.___ (E). – In exercise of the powers conferred by section 109 of the Finance Act, 2015 (No. 20 of 2015), the Central Government hereby appoints the 1st day of April, 2016 as the date on which the provisions of sub-section (1) of section 109 of the said Act shall come into effect.

[F. No. B-1/10/2015 – TRU]

(K Kalimuthu)

Under Secretary to the Government of India

Finance Act 2015

Section 109.In section 66D of the 1994 Act, with effect from such date as the Central Government may, by notification in the Official Gazette, appoint,—

(1) in clause (a), in sub-clause (iv), for the words “support services”, the words “any service” shall be substituted;

(2) for clause (f), the following clause shall be substituted, namely:—

“(f) services by way of carrying out any process amounting to manufacture or production of goods excluding alcoholic liquor for human consumption;”;

(3) in clause (i), the following Explanation shall be inserted, namely:—

‘Explanation.– For the purposes of this clause, the expression “betting, gambling or lottery” shall not include the activity specified in Explanation 2 to clause (44) of section 65B;’;

(4) clause (j) shall be omitted