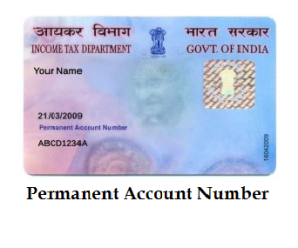

Income Tax Department Simplifies linking PAN with Aadhaar

Income Tax Department simplifies linking PAN with Aadhaar for taxpayers using Income Tax India website; No need to login or be registered on the E-filing website for linking The Income Tax (IT) Department has made it easy for taxpayers to link their PAN with … Continue Reading →