The Direct Tax Dispute Resolution Scheme, 2016

- Eligibility

A declarant can file a declaration in relation to tax arrears or specified tax in respect of which appeal is pending before the CIT(A).

- Tax Arrear

Amount of tax, interest or penalty determined under the IT Act or WT Act, in respect of which appeal is pending before the CIT(A) or CWT(A) as on 29.02.2016. The pending appeal could be against an assessment order or a penalty order

- Specified Tax

Tax determined in consequence of or is validated by an amendment made with retrospective effect in IT Act or WT Act, for a period prior to the date of enactment of such amendment and a dispute in respect of which is pending as on 29.02.2016.

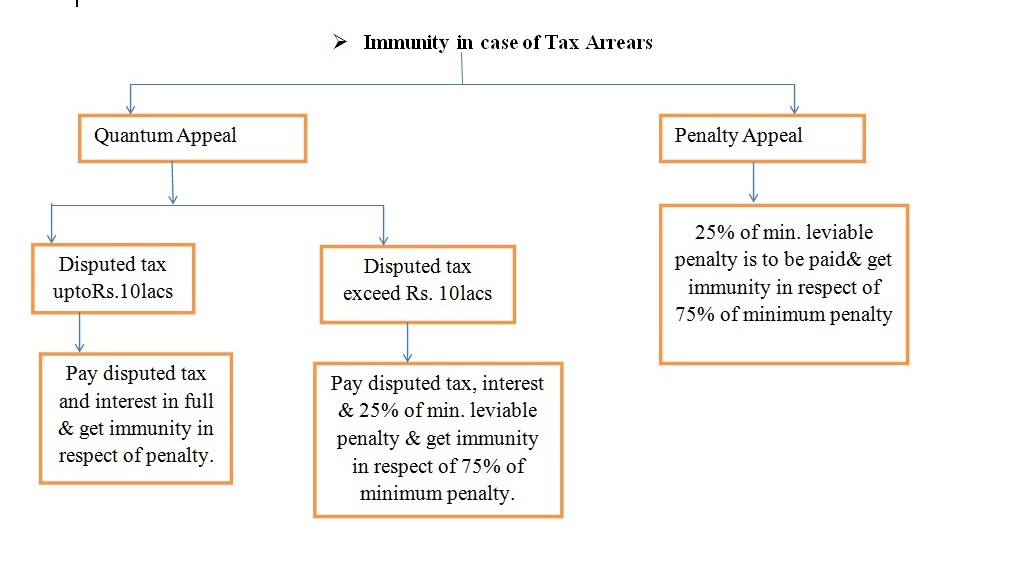

- Immunity

*Immunity in case of specified Tax – only payment of disputed tax is to be done and get full immunity from interest and penalty.

*Immunity from prosecution is available in both the above cases.

- Scheme shall not apply in following cases:-

- cases where prosecution has been initiated before 29.02.2016.

- search or survey cases where the declaration is in respect of tax arrears

- cases relating to undisclosed foreign income and assets

- cases based on information received under DTAA u/s 90 or 90A where the declaration is in respect of tax arrears

- Person notified under Special Courts Act, 1992

- Cases covered under Narcotic Drugs and Psychotropic Substances Act, Indian Penal Code, Prevention of CorruptionAct or Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974

- Procedure

- Declarant to file declaration to the designated authority not below the rank of Commissioner in such form and verified in such manner as may be prescribed

- The designated authority shall within 60 days from the date of receipt of declaration, determine the amount payable by the declarant

- The declarant shall pay such sum within 30 days of passing such order and furnish a proof of such sum

- Any amount paid in pursuance of declaration shall not be refundable

The Direct Tax Dispute Resolution Scheme, 2016 as introduced in Union Budget 2016-17

Other Post Related to Union Budget 2016-17

- Equalisation Levy

- The Income Declaration Scheme 2016

- The Direct Tax Dispute Resolution Scheme, 2016

- The Indirect Tax Dispute Resolution Scheme 2016

- Changes proposed Central Excise Law by Union Budget 2016-17

- CBEC TRU Circular for Excise and Customs Changes in Union Budget 2016-17

- Clarifications on Excise Duty imposed on Jewellery in union Budget 2016-17

- Changes proposed in Service Tax by Union Budget 2016-17

- Krishi Kalyan Cess

- CBEC TRU Circular on Service Tax Changes in Union Budget 2016-17

- Changes in Cenvat Credit Rules by Union Budget 2016-17

- Changes made in Direct Tax Law by Union Budget 2016-17

- Finance Bill 2016 Provisions Relating to Direct Taxes

- Highlights of Union Budget 2016-17

- Union Budget 2016-17

If an assessee has already paid more than 25% of the penalty amount and he decides to opt for the The DTDRS will he get refund of the amount exceeding 25% already paid