Returns Process and Matching of Input Tax Credit in GST: In every Taxation law, Returns provide a framework for working out the tax that becomes payable in the prescribed period applying the legal principles laid down in the tax law to the transactions during the period. A taxable person has a legal obligation:

(i) to declare his tax liability for a given period in the return;

(ii) furnish details about the taxes paid in accordance with that return; and

(iii) file correct and complete return within stipulated time frame.

Statutory Provisions in CGST Act 2017 Related to Returns

Section 37.Furnishing details of Outward Supplies.

Section 38.Furnishing details of Inward Supplies.

Section 39.Furnishing of Returns.

Section 41.Claim of input tax credit and provisional acceptance thereof.

Section 42.Matching, reversal and reclaim of input tax credit.

Section 43.Matching, reversal and reclaim of reduction in output tax liability.

Section 46.Notice to return defaulters.

Section 48.Goods and services tax practitioners.

Apart from above statutory provisions the central Government has also notified the Central Goods and Services Tax Rules 2017 Notification No. 10 /2017 – Central Tax dated 28-06-2017 related to forms and manner of filing GST Returns.

Overview of Various Returns to be Filed in GST

In the GST regime the Returns are totally electronic without any requirement of physical submission. The effort has been to make it as transaction based as possible so that once the tax payer gives the details of transactions, most part of the return is auto generated from details of underlying individual transactions. There shall be one common return for IGST, CGST and SGST that shall be submitted on the GST Common Portal and tax departments will pull the return data relevant to them from the portal for further processing and analysis. The following are the returns/reports at glance to be filed by taxpayer in GST law:

| Form | Particulars | Due date | Applicable for |

| GSTR-1 | Outward Supplies | 10th of the next month | Normal / Regular Taxpayer |

| GSTR-2 | Inward Supplies | 15th of the next month | Normal / Regular Taxpayer |

| GSTR3 | Monthly return [periodic] | 20th of the next month | Normal / Regular Taxpayer |

| GSTR4 | Return by compounding tax payers | 18th of the month next to the quarter | Compounding Taxpayer |

| GSTR5 | Return by non- resident tax payers [foreigners] | 20th of the next month or within 7 days after expiry of registration, whichever is earlier | Foreign Non-Resident Taxpayer |

| GSTR6 | Return by input service distributors | 13th of the next month | Input Service Distributor |

| GSTR7 | TDS | 10th of the next month | Tax Deductor |

| GSTR8 | TCS | 10th of the next month | E-Commerce |

| GSTR-9 | Annual return | 31st December next FY | Normal tax payer(other than casual tax payer) |

| GSTR-9A | Annual return | 31st December next FY | Compounding Taxpayer |

| GSTR-9B | Annual return along with the copy of audited annual accounts and a reconciliation statement | 31st December next FY | Normal tax payer having turnover more than 1 crore |

Must Read: CBEC FAQs on Returns Process and matching of Input Tax Credit

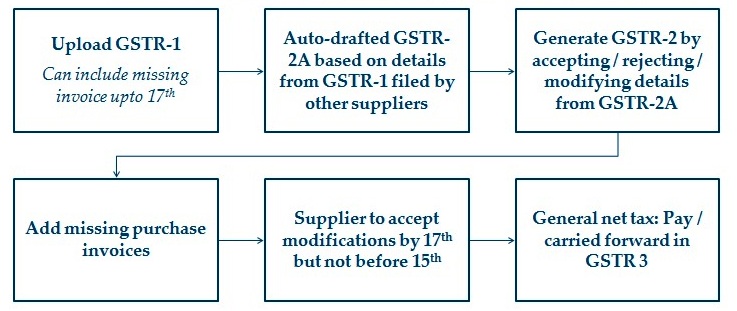

Steps of Filing GST Returns

Salient Features Related to Returns under GST Law

- Every registered person have to compulsorily furnish returns under GST Law.

- Submission of return – Through online mode only. No provision of Physical Returns.

- Return to be filed even if there is no business activity during the return period i.e. Nil Return.

- No Scope for Revision of Returns however the Error or Omission may be rectified in next returns.

- B2B transactions proposed on invoice level – GSTIN, Invoice No. and date, Value, Description, rate of tax and value of Tax.

- B2C invoice wise only for transaction above INR 2.5 lakh and is interstate.

- HSN Codes – Goods and Accounting Codes – Services.

- Separate Tables for Debit / Credit Notes / Input Service Distributor Credit / TDS etc.

- Common e-Return for CGST, SGST/ UTGST and IGST.

- The Taxpayer is not allowed to furnish a return for a tax period if the return for any of the previous tax period has not been furnished by him.

- Late Fee for delay in Filing Returns: Rs.100/- for every day during which such failure continues subject to maximum Rs.5,000/-.

Matching of Input Tax Credit in GST Law

Matching of Input Tax Credit and auto-reversal is one of the core features of GST. The primary reason for having this feature arises from the fact that one of the most important design specification of GST is that it should allow full credit of taxes paid across State boundaries, making it a truly national tax while keeping the federal structure intact. Operationally, it allows a taxpayer registered in one State can take credit of IGST paid to a taxpayer registered in another State against SGST payable by him in his State and vice versa. This requires that whenever a taxpayer takes credit of IGST paid against SGST payable, the Centre transfers an equivalent amount to the relevant State and whenever a taxpayer takes credit of SGST paid against IGST payable, the relevant State transfers an equivalent amount to the relevant Centre.

For smooth operation of such a fund transfer mechanism, which is essential for smooth flow of credit, it is important that a system is in place which ensures that whenever a taxpayer takes credit of any tax paid on his inputs, the tax amount has either already been collected or gets collected in due course. It is also essential that such a system runs without any manual intervention. Matching of input tax credit and auto-reversal provides exactly that mechanism.