CBDT Circular No. 04 of 2023-Income Tax (No.370142/06/2023-TPL) Dated 05-04-2023

Clarification regarding deduction of TDS under section 192 read with sub-section (1A) of section 115BAC of the Income-tax Act, 1961 – reg. In order to avoid the genuine hardship in such cases, the Board, in exercise of powers conferred under section 119 of the Act, hereby directs that a deductor, being an employer, shall seek information from each of its employees having income under section 192 of the Act regarding their intended tax regime and each such employee shall intimate the same to the deductor, being his employer, regarding his intended tax regime for each year and upon intimation, the deductor shall compute his total income, and deduct tax at source thereon according to the option exercised.

Anilkumar Kantilal Trivedi Vs ITO (ITAT Ahmedabad) Date of Order: 17-03-2023

Hon’ble ITAT held that the assessee has sold agricultural land and, therefore, the same cannot be termed as capital asset and will not come under the purview of Section 50C of the Act. The reference to DVO by adopting Fair market Value was not justified in the present case as the said report whether has taken the aspect of Sale Deed of agricultural land or not has not been pointed out by the Assessing Officer. In the present case, the addition in respect of Section 50C is not justifiable since the agricultural land sale was executed on 27.09.2010 at the prevailing Jantri Rate. The registration of the sale deed was after the addition/contractual obligation relating to agricultural land converting into non-agricultural land was completed and the expenses were borne by the buyer and not by the assessee. Therefore, the addition made by the Assessing Officer does not sustain. Appeal of Assessee is Allowed. [Para 11]

Arya Kshatriya Samaj Vs ITO (ITAT Pune) ITA No.175/PUN/2023 Date of Order: 23-03-2023

Hon’ble ITAT held that the provisions of section 12A(ba) provides that the exemption u/s 11(Income from property held for charitable or religious purposes) can be availed only if the return of income was filed in the manner prescribed under the provisions of section 139(4A) of the Act which in turn requires that an assessee claiming exemption of income u/s 11 to file the return of income within the due date prescribed u/s 139(1) of the Act. In the absence of any discretionary power neither the assessing authority nor the appellate authority can relax the provisions of the Statute. Therefore, this is a clearly inadmissible claim as defined under sub-clause (ii) of clause (a) of section 143(1), the CPC was justified in denying the claim for exemption u/s 11, while processing the return of income u/s 143(1) of the Act. Therefore, we do not find any merits in the appeal filed by the assessee.

The Finance Act, 2023 (No. 8 of 2023): The Government has notified the Finance Act following the assent of the President on March 31. This will give effect to financial proposals of the Central Government for FY2023-24.

[MINISTRY OF LAW AND JUSTICE (Legislative Department) New Delhi, the 31st March, 2023 / Chaitra 10, 1945 (Saka) The following Act of Parliament received the assent of the President on the 31st March, 2023 and is hereby published for general information:— THE FINANCE ACT 2023 No. 8 OF 2023 pdf

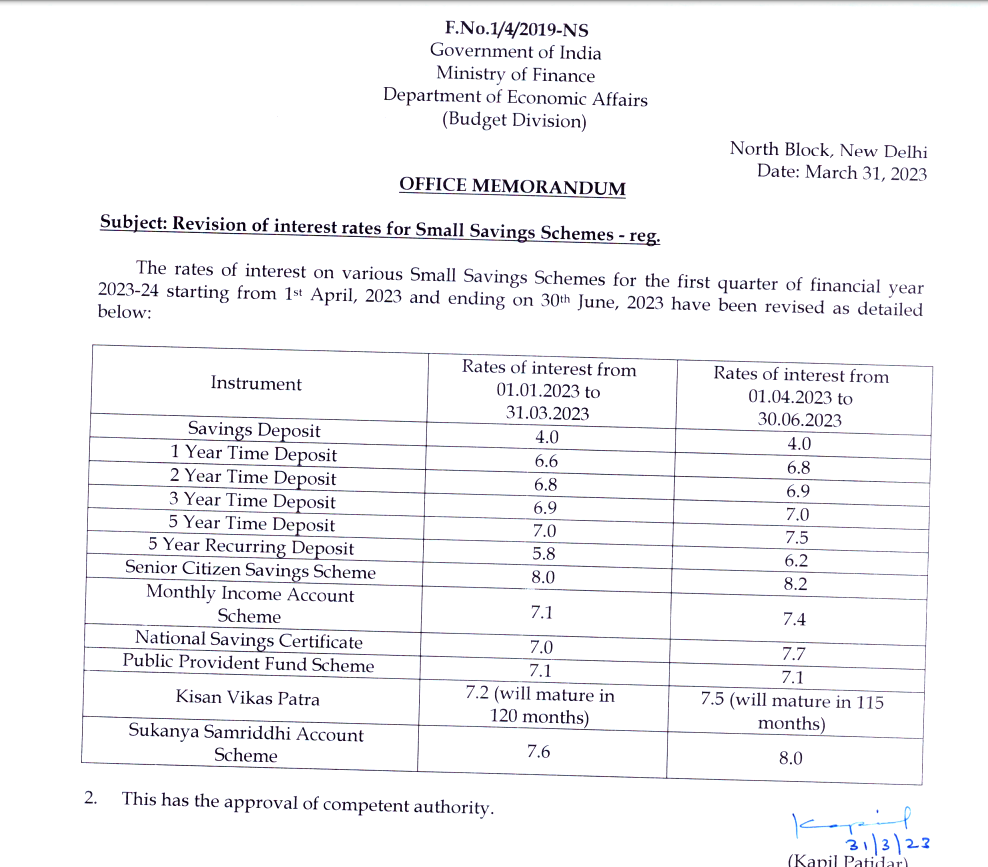

Government of India vide F. No.1/4/2019-NS Dated 31-03-2023 Increased Interest rates of small saving schemes for the First quarter of financial year 2023-24 starting from 1st April, 2023 and ending on 30th June, 2023. Rate in case of Small saving schemes NSC, Senior Citizen Savings Schemes, Sukanya Samriddhi Account Scheme, Kisan Vikas Patra has been increased. However, the interest rate on PPF accounts is unchanged.

Weekly Newsletter Income Tax and Other Law [April, 2023] Income Tax Law; Corporate Law, Personal Finance

![Weekly Newsletter Income Tax, GST and Other Law [2nd Week, June 2022]](http://taxindiaupdates.in/wp-content/uploads/2021/12/Untitled-120x120.png)