HUF Taxation in India

What is HUF?

- Sec. 2(31) of the IT Act, 1961 defines the word ‘person’, which includes HUF. Therefore, HUF is a separate assessable entity under the Income Tax Act, 1961 and Wealth Tax Act, 1957.

- No separate definition of the expression HUF has been given under the IT Act, 1961. However, this term has a definite connotation under the Hindu Law

- It is a body consisting of males lineally descended from a common ancestor, their wives and daughters, both unmarried and after 01.09.2005 also the married.

- Prior to 01.09.2005, the daughter, on her marriage, ceases to be a member of her father’s HUF and becomes a member of her husband’s HUF. However, after 01.09.2005, married daughter is a member both of her father’s HUF as well as husband’s HUF.

Who is a Co-parcener?

- A co-parcener is that member of HUF who acquires interest by birth in the joint property of the family.

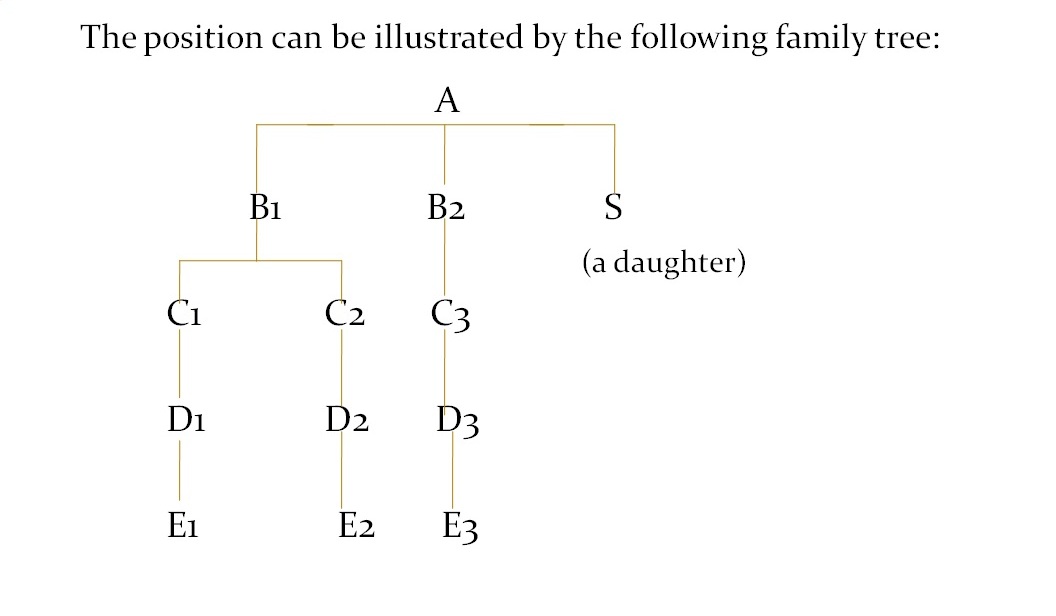

- The co-parcenery, therefore, consists of a common male ancestor and his lineal descendants in the male line within 4 degrees, running from and including such ancestor.

- W.e.f. 09.09.2005, due to the amendment of the Hindu Succession Act, the daughter of a coparcener shall by birth become a coparcener in her own right in the same manner as the son. Thus, now a married daughter is a coparcener in her father’s HUF but only a member in her husband’s HUF.

- A coparcener thus consist s of:

1st degree: Holder of ancestral property

2nd degree: Sons and daughters

3rd degree: Grandsons

4th degree: Great Grandsons

Difference between a Co-Parcener and a Member

- All the coparceners are members of HUF but all the members of HUF are not coparceners. Therefore, wives are only members but not coparceners in the HUF.

- Only coparceners can ask for partition in the family. The members of the family who are not coparceners have no direct claim over HUF property but can claim only through the coparceners.

- After 01.09.2005, daughter continues to be a coparcener of her father’s family and she can demand partition of her father’s HUF property. However, as far as her husband’s HUF is concerned, she is a mere member of the family and not a coparcener and as such cannot demand partition of her husband’s HUF property. But would be entitled to a share in case of partition between her husband & her sons or between her sons.

Who can become Karta?

- The senior most male coparcener

- If Karta passes away, the next heir in line can be karta

- A minor male coparcener may also act as a Karta through his legal guardian till he becomes a major

- Daughter being coparcener can also be a karta

- The right to be a Karta can be given up and the next son or daughter in line can take his place.

Doctrine of Blending

- If the coparcener makes a declaration blending his individual property with that of HUF or impress such property with the character of HUF property or throws the property in the common hotchpot- such property becomes HUF property and loses the character of individual or separate property.

- The female member of the family cannot blend her individual property into the HUF as blending is a power given only to coparceners. However, such an act shall be considered as a gift and it shall become property of the HUF.

- Daughter, being a coparcener can blend her individual property into HUF.

Clubbing Provisions

- The clubbing provisions u/s 64(2) of the IT Act shall apply. The income arising from such converted property will be included in the total income of the individual who was the owner of such property.

- Where the converted property has been subject matter of partition amongst the member of the family, the income derived from such converted property as is received by the spouse, shall continue to be taxed in the hands of the transferor individual.

- Income in respect of the property allotted to minor children till minority shall be clubbed in the hands of the father on account of overriding provisions contained u/s 64(1A) of the IT Act. However, transferor can claim exemption upto Rs.1,500/- u/s 10(32).

- What is to be clubbed is the income arising from the assets transferred. However, income derived on the accretion of such property or from the accumulated income from such property cannot be clubbed.

Gift received by an HUF from member

- Section 56(2)(vii) inserted by Finance (No. 2) Act, 2009 w.e.f. 01.10.2009 provides that where an individual or a HUF receives, in any previous year, from any person or persons, any sum of money, without consideration, the aggregate value of which exceeds Rs. 50,000/-, the whole of the aggregate value of such sum will be chargeable to income tax under the head ‘Income from other sources’.

- The section also taxes the gift of any immovable property or any property, other than immovable property received without consideration or inadequate consideration where the difference between the stamp value/fair market value and the actual consideration exceeds Rs.50,000/-.

- However, certain exceptions are provided from the operation of this law. One such exception is that if any sum of money or any property is received from any relative, then no tax would be chargeable in the hands of the recipient.

- The meaning of ‘relative’ has been given in the Explanation to section 56(2) as follows:-

In case of an Individual

– spouse of the individual;

– brother or sister of the individual;

– brother or sister of the spouse of the individual;

– brother or sister of either of the parents of the individual;

– any lineal ascendant or descendent of the individual;

– any lineal ascendant or descendent of the spouse of the individual;

– spouse of the person referred to in clauses (ii) to (vi)

In case of a HUF:- any member thereof (By the Finance Act, 2012 w.r.e.f. 01.10.2009)

Whether any gifts received by the HUF from Karta or its members or relative of these persons are liable to tax or not?

This issue has been considered by the Hon’ble ITAT, Ahmadabad Bench in case of Harshadbhai Dahyalal Vaidya (HUF) Vs. ITO (2013) 144 ITD 605/88 DTR 288. In this case, pertaining to A.Y. 05-06, assessee-HUF received certain sum of money as gift from a relative of its Karta. The AO brought the said amount to tax under the head ‘income from other sources’ by holding that the word ‘relative’ defined in the Explanation annexed to section 56(2)(v) is applicable only in the case of an individual and not to the HUF. The Hon’ble ITAT after examining the definition of ‘relative’ concluded as under:-

(i) The definition of ‘relative’ in the year under consideration i.e. A.Y. 05-06 is in respect of relationship by an individual donee with close relatives as defined therein. However, it is very pertinent to note that the operative section i.e. sec. 56(2)(v) is in respect of (i) individual and (ii) HUF. Meaning thereby, the legislature has clear intention to include both the status i.e. individual as well as HUF within its scope and operation

(ii) The proviso prescribes that the charging of the gifted amount shall not apply to any sum of money received as a gift from a ‘relative’. Naturally, the proviso does not restrict to an ‘individual’ but it governs ‘individual’ as well as an ‘HUF’.

(iii) Therefore, since the assessee-HUF has undisputedly received a gift from a relative who is an uncle of the Karta of this HUF, i.e. as per Explanation, sub clause (iv) ‘brother or sister of either of the parents of the individual’, hence falls within the category of the ‘relative’ prescribed in the Act, therefore not chargeable to tax in the hands of the assessee.

However, Finance Act 2012 w.r.e.f. 01.10.2009 has specifically provided that in case of HUF any gifts received from its member only will not be taxable. Therefore, the gift received by HUF from the relatives of its member would be taxable and the above case may not hold good.

Gift given by an HUF to member

- A Hindu father has no power to gift away ancestral or joint property to either members of the family or strangers. However, for the following purpose, he has the power of making gifts of ancestral moveable property within reasonable limits:-

– Purpose of performing indispensable acts of duty

– Purpose prescribed by texts of law, as gift through affection

– Pious Purpose

- Gift by a father to his daughter of ancestral property on the occasion of her marriage is gift in discharge of an indispensable duty and is valid in Hindu law.

- A “gift of affection” may be made to a wife, to a daughter and even to a son. But the gift must be of property within reasonable limits.

- A gift of the whole or almost the whole of the ancestral moveable property to one son to the exclusion of the other sons, cannot be upheld as a “gift through affection”.

- Reasonable limits depends upon facts [Commissioner Of Gift Tax Vs. Bhupathiraju Venkata Narasimharaju 101 ITR 74 (AP) (HC)]

- Combined reading of the Hindu Law and various judicial precedents shows that the Karta has the power to gift ancestral movables within reasonable limits but he has restricted power with regard to ancestral immovable property. He can however, make a gift of ancestral immovable property within reasonable limits for pious purpose [CIT v Ram Gopal Rajgharia 123 ITR 693 (Patna) (HC)]

- Section 10(2) provides that any sum received by an individual as a member of a HUF where such sum has been paid out of the income of the family will not be included in the total income of the individual. Thus, the gift received by the member of HUF from its HUF is exempt from tax.

- Whether any gift received by the assessee, a member of HUF, from the HUF is gift received from relatives?

– In case of Vineetkumar Raghavjibhai Bhalodia Vs. ITO (2011) 58 DTR 412 (Rajkot) (Trib.), the assessee, a member of HUF received gift from its HUF. The AO held that since HUF is not covered in the definition of “relative”, gift received from HUF is taxable.

- It was held that an HUF consists of all the persons lineally descended from a common ancestor and includes their mothers, wives or widows and unmarried daughters. All these persons fall within the definition of “relative” as provided in Explanation to s. 56(2)(vi). Thus, an HUF is a ‘group of relatives’. Intension of the legislature as evident from a plain reading of s. 56(2)(vi) read with Explanation thereto is that gift received from “relative” whether from an individual relative or from a group of relatives is exempt from tax u/s 56(2)(vi). It is not expressly stated in the Explanation that the word “relative” connotes a single person. Sometimes a singular can mean more than one, as in this case. Therefore, the term “relative” explained in Explanation to s. 56(2)(vi) includes “relatives”. Hence, gift received by the assessee, a member of HUF, from the HUF is gift received from relatives and it is not taxable u/s 56(2)(vi).

– Further, gift received by a member of HUF out of the income of the family of any year is exempt under s. 10(2)

Partition of HUF

- Partition of HUF can be:-

(a) Total or complete partition

(b) Partial partition

Total/Complete partition:- Where all the properties of the family are divided amongst all the constituents of the family and the family ceases to be exists as an undivided family, it is known as total or complete partition

Partial partition:- On the other hand, if some of the constituents of the HUF go out of the fold, others remaining joint, or some of the properties are divided and balance remain joint, it is known as partial partition.

- Partition can only be claimed by a coparcener. But when there is a partition of HUF the following persons are entitled to a share in the assets of the HUF:-

- All coparceners

- Mother is entitled to a share equal to the share of a son in the case of death of the father.

- Wife gets a share equal to that of a son if a partition takes place between her husband and his sons. She enjoys this share separately even from her husband

- A son in the womb of the mother at the time of the partition

- After the partition, the assessment of HUF shall be made as per the provisions of section 171 of IT Act and order to be passed by the AO.

- Distribution of asset of an HUF in the course of partition would not attract any capital gains tax liability as it does not involve transfer

Tax Implications of Partial Partition

- As per section 171(9) of the IT Act, the partial partition after 31.12.1978 is not recognized.

- Even after Partial Partition, the income of the HUF shall be liable to be assessed under the Income-tax Act as if no Partial Partition had taken place.

- Each member of such family immediately before such partition and the family shall be jointly and severally liable for any tax, penalty, interest, fine or any other sum payable by the family in respect of any period whether before or after such partial partition.

- No order u/s 171(1) will be passed by AO

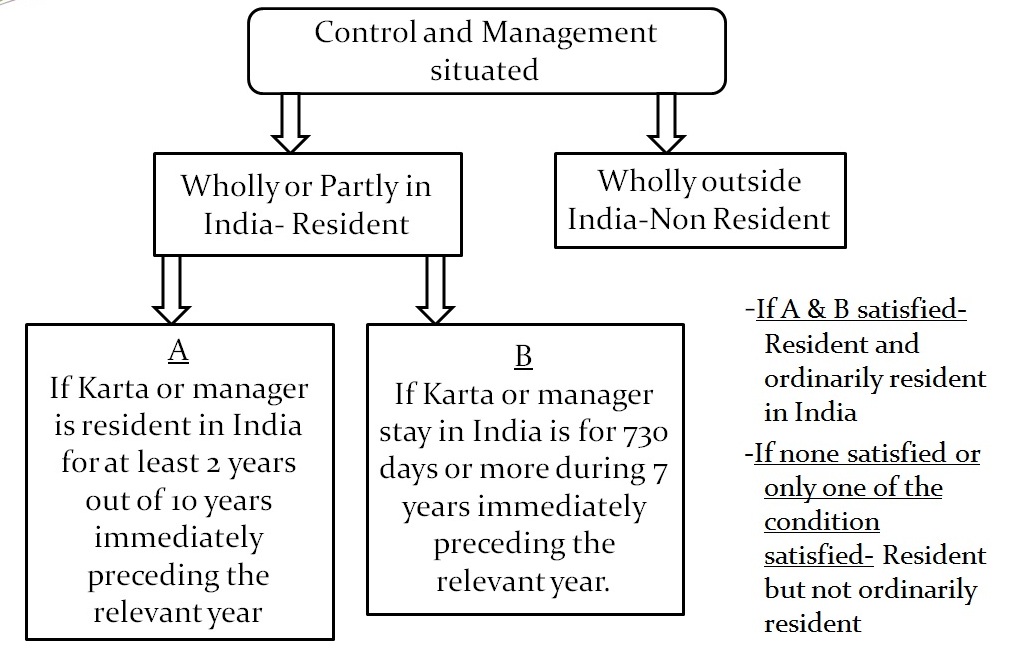

Residential status of an HUF

Other Issues

If the member of the HUF become partner in a firm as a result of the investment made in such firm out of family funds, then how will be the remuneration received by the member will be treated?

– Any fee or remuneration received by a member of the HUF as a partner in a firm which is as a result of the investment made in such concern out of the funds of HUF, shall be treated as income of HUF. However, if such remuneration is earned by the member as a partner for services rendered purely in his personal capacity shall be treated as income of the individual and not the HUF.

Can remuneration paid by the HUF to its Karta be allowed as deduction?

– If remuneration is paid to Karta of HUF (a) under a valid agreement which is bona fide (b) in the interest of and expedient for the business of the family and (c) the payment is genuine and not excessive, such remuneration paid wholly and exclusively for the business of the family, shall be allowable as an expenditure while computing the income of HUF and such salary will be taxable in the hands of Karta as his individual income.

Whether remuneration received by wife of Karta from a partnership firm in which such Karta has a substantial interest will be clubbed in the hands of Karta?

– Sec.64(1)(ii) provides that while computing the total income of the individual, any income arising to the spouse of such individual by way of salary, commission, fees or any other form of remuneration from a concern in which such individual has substantial interest shall be clubbed in the hands of such individual. In the present case, the person is a partner in a partnership firm not in his individual capacity but as the Karta of the HUF and thus the income accruing to his wife on account of her being a partner in the same partnership firm cannot be included in the total income of such person in an individual assessment or in the assessment of the HUF.

The assessee was a partner in a firm which was dissolved with effect from 1-1-1999 and its business was taken over by the assessee in the capacity of a HUF. The assessee sought to set-off loss of the said firm against the profit of his business as HUF. Whether the contention of assessee is correct?

– Section 78(2) prohibits carry forward and set-off of losses of one person by another person except when the other person receives the losses by inheritance. It shows that where succession to business is by inheritance, then loss will be allowed to be set-off and not otherwise. In the present case, the two partners retired and the firm was dissolved and the business was taken over by the HUF. There is no inheritance involved and therefore the assessee is not entitled to carry forward and set off of losses of the firm against the income of HUF.